Executive Summary

The advancement of Singapore’s equity market and the launch of initiatives like Monetary Authority of Singapore’s (“MAS“) S$5 billion Equity Market Development Programme and MAS/Singapore Exchange’s (“SGX“) S$30 million Value Unlock Programme provide companies with valuable support to boost transparency and trust. The Value Unlock Programme helps listed companies enhance investor engagement and achieve fair valuation by addressing strategy and communication gaps. The evolving capital markets also means that investor confidence relies on clear forward-looking disclosures by listed issuers. This Update provides an overview of the Value Unlock Programme and explores Singapore Exchange Regulation’s (“SGX RegCo“) Regulator’s Column: Forward Guidance – Why It Matters and How to Get It Right which gives critical pointers on effective forward guidance. Please reach out to our Contact Partners to support your journey in unlocking your business’ full potential.

Value Unlock Programme

The Value Unlock Programme is a strategic initiative by SGX and MAS to help listed companies strengthen investor engagement and achieve fair market valuation, anchored on three pillars:

- Capabilities (building corporate strategy and investor relations skills);

- Communications (communicating strategic plans effectively and consistently); and

- Communities (connecting issuers and investors through platforms, such as Singapore Institute of Directors’ Chairpersons Guild).

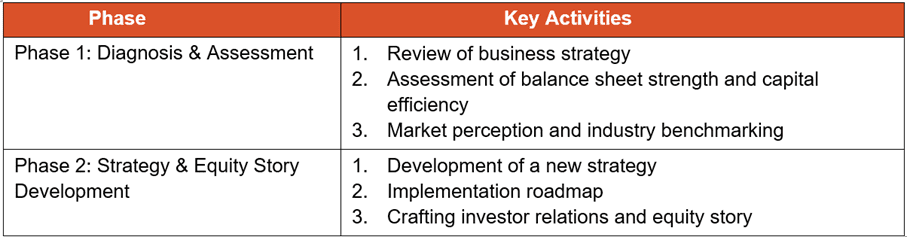

The unlocking strategy comprises two phases:

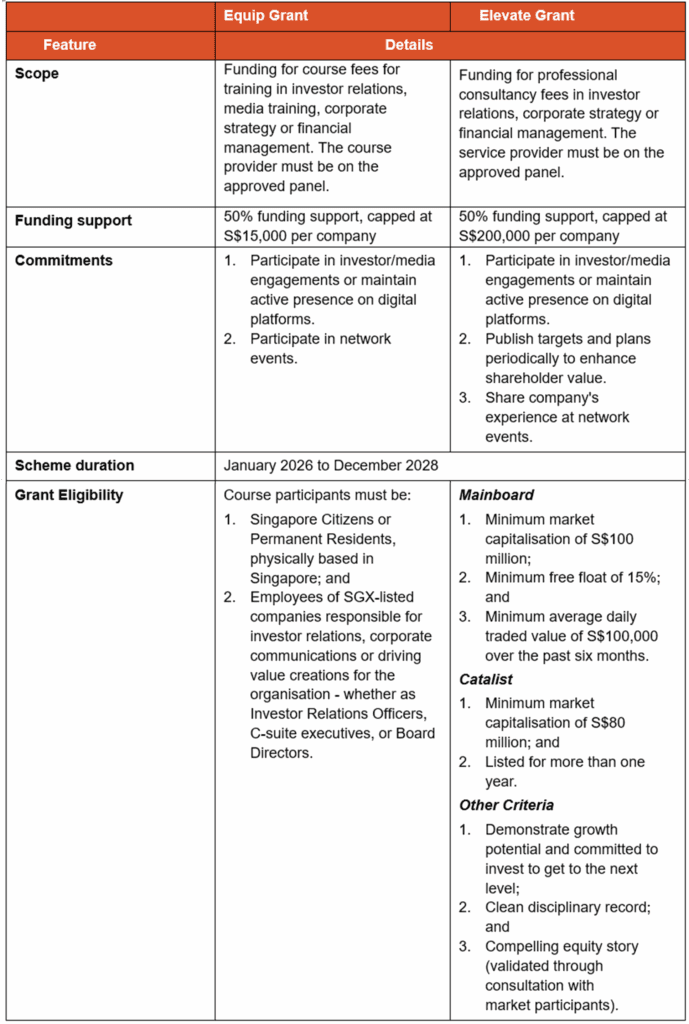

There are two grants (the Equip Grant and the Elevate Grant) under this programme.

For information on the list of eligible courses and programmes and eligible companies who wish to participate in the Elevate Grant, please contact SGX at [email protected]. Service providers who are interested in joining the panel may also contact SGX at [email protected].

SGX RegCo’s Pointers on Forward Guidance

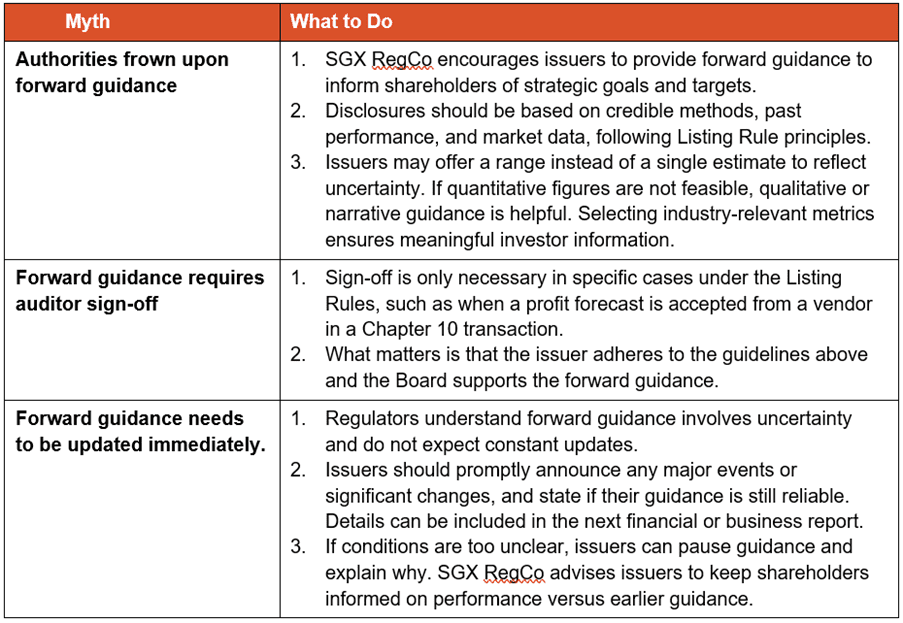

Forward-looking statements are commonly referred to as earnings or forward guidance. SGX RegCo has clarified three biggest myths on forward guidance, as summarised below:

Three Key Points

- Issuer is ultimately responsible for the accuracy and integrity of their announcements, including forward guidance. Issuers must disclose all material information, including forward-looking statements, via SGXNet.

- Understanding Uncertainty: Investors should recognise that forward guidance inherently pertains to an uncertain future. It is unreasonable to expect issuers to fulfil their projections with absolute certainty.

- SGX RegCo adopts sensible regulatory oversight when reviewing compliance with the Listing Rules. Forward-looking disclosures made in good faith, with adequate explanations of the basis and uncertainties involved, generally will not trigger regulatory queries.

SGX RegCo supports disclosures that foster transparency and informed decision-making. Forward guidance is not merely a compliance requirement, but a tool for competitive advantage.

If you have any queries on the above, please reach out to our Contacts or KM at [email protected].

Disclaimer

Rajah & Tann Asia is a network of member firms with local legal practices in Cambodia, Indonesia, Lao PDR, Malaysia, Myanmar, the Philippines, Singapore, Thailand and Vietnam. Our Asian network also includes our regional office in China as well as regional desks focused on Brunei, Japan and South Asia. Member firms are independently constituted and regulated in accordance with relevant local requirements.

The contents of this publication are owned by Rajah & Tann Asia together with each of its member firms and are subject to all relevant protection (including but not limited to copyright protection) under the laws of each of the countries where the member firm operates and, through international treaties, other countries. No part of this publication may be reproduced, licensed, sold, published, transmitted, modified, adapted, publicly displayed, broadcast (including storage in any medium by electronic means whether or not transiently for any purpose save as permitted herein) without the prior written permission of Rajah & Tann Asia or its respective member firms.

Please note also that whilst the information in this publication is correct to the best of our knowledge and belief at the time of writing, it is only intended to provide a general guide to the subject matter and should not be treated as legal advice or a substitute for specific professional advice for any particular course of action as such information may not suit your specific business and operational requirements. You should seek legal advice for your specific situation. In addition, the information in this publication does not create any relationship, whether legally binding or otherwise. Rajah & Tann Asia and its member firms do not accept, and fully disclaim, responsibility for any loss or damage which may result from accessing or relying on the information in this publication.